Several technology-driven trends are converging in a way that will transform the automotive industry into a software-and services-focused landscape. To survive, industry players need to acquire a set of new skills that range from becoming excellent software developers to cooperating with peers and new entrants so that they can achieve the positions they need to survive.

Technology-driven trends will revolutionize how industry players respond to changing consumer behavior, develop partnerships, and drive transformational change.

Today’s economies are changing dramatically, triggered by development in emerging markets, the accelerated rise of new technologies, sustainability policies, and changing consumer preferences around the ownership of everything from homes to cars. Digitization, increasing automation, and new business models have revolutionized other industries, and automotive will be no exception. These forces are giving rise to four disruptive technology-driven trends in the automotive sector: diverse mobility, autonomous driving, electrification, and connectivity.

Defining eight key industry disruptions

Most industry players and experts agree that the four trends will reinforce and accelerate one another, and that the automotive industry is ripe for disruption. Given the widespread understanding that game-changing disruption is already on the horizon, there is still no integrated perspective on how these trends will change the industry in 10 to 15 years.

To that end, the following eight key perspectives on the “2030 automotive revolution” provide scenarios regarding the kinds of changes ahead, and their effect on traditional vehicle manufacturers and suppliers, potential new players, regulators, consumers, markets, and the automotive value chain. This study aims to make the imminent changes more tangible. The forecasts represent a projection of the most probable assumptions across all four trends, based on current understanding. They should help industry players to prepare for uncertainties better by revealing potential future states.

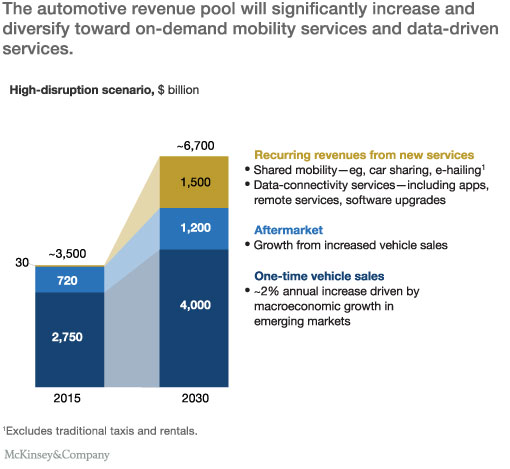

1) Driven by shared mobility, connectivity services, and feature upgrades, new business models could expand automotive revenue pools by about 30 percent, adding up to $1.5 trillion in value.

The automotive revenue pool will significantly increase and diversify toward on-demand mobility and data-driven services. This could create up to $1.5 trillion—or 30 percent more—in additional revenue potential in 2030, compared with about $5.2 trillion from traditional car sales and aftermarket products and services, which itself is

50 percent increase from the approximately $3.5 trillion the industry generated in 2015

Exhibit 1

Connectivity, and later autonomous technology, will increasingly turn the automobile into a platform for drivers and passengers to use their time in transit to consume infotainment services and engage in other personal activities. The increasing speed of innovation, especially in software-based systems, will make upgradability a key feature of future cars. As shared mobility solutions with shorter life cycles become commonplace, consumers will constantly seek technological advances, which will further increase demand for upgradability in privately used cars as well.

2) Despite a shift toward shared mobility, vehicle unit sales will continue to grow, but likely at a lower rate of about 2 percent per year.

Overall, global car sales will continue to grow, but the annual growth rate will likely drop from the 3.6 percent over the last five years to around 2 percent by 2030. Macroeconomic factors will largely drive this decline, along with the rise of new mobility services such as car sharing and e-hailing.

A detailed analysis suggests that dense areas with a large, established vehicle base are fertile ground for new mobility services, and many cities and suburbs in Europe and North America fit this profile. New mobility services may result in a decline of private-vehicle sales, but this decline is likely to be offset by increased sales in shared vehicles that need to be replaced more often due to higher utilization and related wear and tear.

The remaining driver of growth in global car sales is the overall positive macroeconomic development, including the rise of the global consumer middle class. With established markets slowing their expansion, however, growth will continue to rely on emerging economies, particularly China, while product-mix differences will explain different development of revenues.

3) Consumer mobility behavior is changing, with the potential for one in ten cars sold in 2030 being a shared vehicle and the subsequent rise of a market for fit-for-purpose mobility solutions.

Changing consumer preferences, tightening regulation, and technological breakthroughs add up to a fundamental shift in individual mobility behavior. Consumers increasingly use multiple modes of transportation to complete their journey; consumers have goods and services delivered rather than picking them up personally. As a result, the traditional car sales business model will become but one of a range of diverse, on-demand mobility solutions, especially in dense urban environments that proactively discourage private-car use.

Consumers today use their cars as all-purpose vehicles, whether they are commuting alone to work or taking the whole family to the beach. In the future, they may want the flexibility to choose the best solution for a specific purpose, on demand and via their smartphones. Early signs are already emerging that the importance of private-car ownership is declining. In the United States, for example, the share of young people (16 to 24 years of age) who hold a driver’s license dropped from 76 percent in 2000 to 71 percent in 2013. At the same time, the number of car-sharing members in North America and Germany has increased by more than 30 percent annually over the last five years.

Consumers’ new habit of using tailored solutions for each purpose will lead to new segments of specialized vehicles designed for very specific needs. For example, the market for a car specifically built for e-hailing services—that is, a car designed for high utilization, robustness, additional mileage, and passenger comfort—would already be millions of units today, and this is just the beginning.

Because of this shift to diverse mobility solutions, up to one out of ten new cars sold in 2030 will likely be a shared vehicle, which could reduce the sales of private-use vehicles. This would mean that more than 30 percent of the miles driven in new cars sold could be from shared mobility. On this trajectory, one out of three new cars sold could potentially be a shared vehicle as soon as 2050.

4) City type will replace country or region as the most relevant segmentation dimension that determines mobility behavior and, thus, the speed and scope of the automotive revolution.

Understanding where future business opportunities lie requires a more granular view of mobility markets than ever before. Specifically, marketers need to segment these markets by city types based primarily on their population density, economic development, and prosperity. Across those segments, consumer preferences, policy and regulation, and the availability and price of new business models will strongly diverge. In megacities such as London, for example, car ownership is already becoming a burden for many due to congestion fees, a lack of parking, traffic jams, and other issues. By contrast, in rural areas such as the state of Iowa in the United States, private-car usage will remain the preferred means of transport by far.

The type of city will thus become the key indicator for mobility behavior, replacing the traditional regional perspective on the mobility market. By 2030, the car market in New York will likely have much more in common with the market in Shanghai than the one in Kansas.

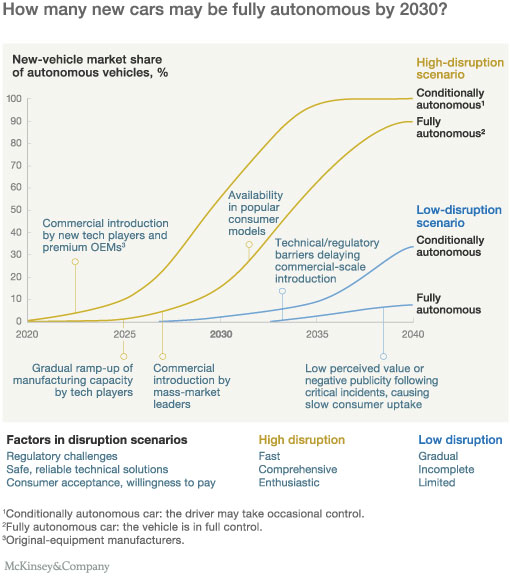

5) Once technological and regulatory issues have been resolved, up to 15 percent of new cars sold in 2030 could be fully autonomous.

Fully autonomous vehicles are unlikely to be commercially available before 2020. Meanwhile, advanced driver-assistance systems (ADAS) will play a crucial role in preparing regulators, consumers, and corporations for the medium-term reality of cars taking over control from drivers.

The market introduction of ADAS has shown that the primary challenges impeding faster market penetration are pricing, consumer understanding, and safety/security issues. Regarding technological readiness, tech players and start-ups will likely also play an important role in the development of autonomous vehicles. Regulation and consumer acceptance may represent additional hurdles for autonomous vehicles. However, once the industry addresses these challenges, autonomous vehicles will offer tremendous value for consumers (for example, the ability to work while commuting, or the convenience of using social media or watching movies while traveling).

A progressive scenario would see fully autonomous cars accounting for up to 15 percent of passenger vehicles sold worldwide in 2030 (Exhibit 2).

Exhibit 2

6) Electrified vehicles are becoming viable and competitive; however, the speed of their adoption will vary strongly at the local level.

Stricter emission regulations, lower battery costs, more widely available charging infrastructure, and increasing consumer acceptance will create new and strong momentum for the penetration of “electrified vehicles” (e.g., hybrid, plug-in, battery electric, and fuel cell) in the coming years. The speed of adoption will depend on the interaction of consumer pull (partially driven by total cost of ownership) and regulatory push, which will vary strongly at the regional and local level.

In 2030, the share of electrified vehicles could range from 10 percent to 50 percent of new-vehicle sales. Adoption rates will be highest in developed, densely populated cities with strict emission regulations and consumer incentives (e.g., tax breaks, special parking and driving privileges, and discounted electricity pricing). Sales penetration will be slower in small towns and rural areas with lower levels of charging infrastructure and higher dependency on driving range.

Through continuous improvements in battery technology and cost, local differences will diminish, and electrified vehicles should gain more market share from conventional vehicles. With battery costs potentially decreasing to $150 to $200 per kilowatt-hour over the next decade, electrified vehicles will achieve cost competitiveness with conventional vehicles, creating the most significant catalyst for market penetration. At the same time, electrified vehicles include a large portion of hybrid electrics, which means that even beyond 2030, the internal-combustion engine will remain very relevant.

7) Within a more complex and diversified mobility-industry landscape, incumbent players will compete simultaneously on multiple fronts and cooperate with competitors.

While other industries, such as telecommunications or mobile phones/handsets, have already been disrupted, the automotive industry has seen very little change and consolidation so far. For example, only two new players have appeared on the list of the top-15 automotive original-equipment manufacturers (OEMs) in the last 15 years, compared with ten new players in the handset industry.

A paradigm shift to mobility as a service, along with new entrants, will inevitably force traditional car manufacturers to compete on multiple fronts. Mobility providers, tech giants, and specialty OEMs increase the complexity of the competitive landscape. Traditional automotive players that are under continuous pressure to reduce costs, improve fuel efficiency, reduce emissions, and become more capital-efficient will feel the squeeze, likely leading to shifting market positions in the evolving automotive and mobility industries, potentially driving consolidation or new forms of partnerships among incumbent players.

In another game-changing development, software competence is increasingly becoming one of the most important differentiating factors for various domain areas, including ADAS/active safety, connectivity, and infotainment. Going forward, as cars increasingly join the connected world, automakers will have no choice but to participate in the new mobility ecosystems that emerge because of technological and consumer trends.

8) New market entrants will likely initially target only specific, economically attractive segments and activities along the value chain before potentially exploring other opportunities.

Diverging markets will open opportunities for new players, which will initially focus on a few selected steps along the value chain and target only specific, economically attractive market segments—and then expand from there. While a number of current high-tech player are currently generating significant amounts of interest, they probably represent just the tip of the iceberg. Many additional new players are likely to enter the market, especially cash-rich high-tech companies and start-ups. These new entrants from outside the industry are also wielding more influence with consumers and regulators (that is, generating interest around new mobility forms and lobbying for favorable regulation of new technologies). Similarly, some Chinese car manufacturers, with impressive sales growth recently, might leverage the ongoing disruptions to play an important role globally.

Preparing for change

Automotive incumbents can’t predict the future of the industry with certainty. However, they can make strategic moves now to shape its evolution. To get ahead of inevitable disruptions, incumbent players need to implement a four-pronged strategic approach:

- Prepare for uncertainty. Success in 2030 will require automotive players to shift to a continuous process of anticipating new market trends, exploring alternatives and complements to the traditional business model, and exploring new mobility business models and their economic and consumer viability. This will require a sophisticated degree of scenario planning and agility to identify and scale new attractive business models.

- Leverage partnerships. The industry is transforming from competition among peers toward new competitive interactions, but also partnerships and open, scalable ecosystems. To succeed, automotive manufacturers, suppliers, and service providers need to form alliances or participate in ecosystems—for example, around infrastructure for autonomous and electrified vehicles.

- Drive transformational change. With innovation and product value increasingly defined by software, OEMs need to align their skills and processes to address new challenges like software-enabled consumer value definition, cybersecurity, data privacy, and continuous product updates.

- Reshape the value proposition. Car manufacturers must further differentiate their products and services and change their value propositions from traditional car sales and maintenance to integrated mobility services. This will put them in a stronger position to retain a share of the globally growing automotive revenue and profit pool, including new business models such as online sales and mobility services, and cross-fertilizing the opportunities between the core automotive-business and new mobility-business models.

* * *

The eight disruptions described here will effectively upend some long-standing conventions in the automotive industry. These changes will require long-time industry players to adopt new ways of doing things and to collaborate more with both incumbents and new entrants, putting a premium on flexibility and agility. It means trying out new business models, experimenting with different value propositions and learning to handle uncertainty. While the automotive industry will change significantly going forward, current players can stake out new positions that enable them to benefit from these transformations.

Source: McKinsey&Company